how are property taxes calculated at closing in florida

In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on the deed. The seller is responsible.

Reasons To Own A Home Home Ownership Buying First Home Tampa Real Estate

This means that though the seller is responsible for paying property taxes for every day they owned their home closing costs will typically include a prorated property tax credit to the buyer.

. The assessment ratio is the ratio of the home value as determined by an official appraisal usually completed by a county assessor and the value as determined by the market. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. Youll owe property taxes for the portion of the year you owned the house be it 30 days or 300 days.

31 then youre responsible for paying two months of real estate taxes to the seller. Then there are the taxes. Title and lien search fees 200.

For the Florida median home value of 252000 this comes to 1512 outside of Miami-Dade or 1764 inside Miami-Dade. Remember these averages are based on sample data. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000.

This estimator is based on median property tax values in all of Floridas counties which can vary widely. In the state of Florida property taxes are sent at the end of a calendar year and are paid in arrears ie one year behind the current year. Prorate the taxes if necessary.

The median property tax on a 18240000 house is 176928 in Florida. For a more specific estimate find the calculator for your county. Count the number of full months from closing day to June 30.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. At closing the parties usually sign a re-proration Agreement agreeing to re-calculate the taxes owed.

Everywhere in Florida outside of Miami-Dade County its calculated at 60 cents per 100 of the value on the deed. Florida is ranked number twenty three out of the fifty states in order of the average amount of property. Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day.

Tax amount varies by county. The median property tax on a 18240000 house is 191520 in the United States. Determine the sellers amount due.

The taxes are assessed on a calendar year from Jan through Dec 365 days. HoA estoppel letter fees 200. Floridas average real property tax rate is 098 which is slightly lower than the US.

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. Sellers in Florida should expect to pay around 1 to 3 of the total sales price in closing costs but its important to note that this doesnt include realtor fees which average 6 in Florida and are paid at closing. If the annual taxes are 1200 then youll see a 200 real estate tax expense on your closing costs for the two months you owe.

All of these extraneous costs will be prorated to your closing date. Florida transfer taxes are the same in every county with the exception of Miami-Dade. Property taxes in Florida are paid in arrears.

The actual amount of the taxes is 477965. Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property. 15 closing there are 8 full months or 240 days.

Florida real property tax rates are implemented in millage rates which is 110 of a percent. Youll likely be subject to property and transfer taxes when you add those in youre looking at around 821344 in closing costs after taxes. To arrive at the assessed value an assessor first estimates the market value of.

Total Price100 x 70 Doc Stamps Cost. 350 30 1167 per day on a 30-day calendar. For example if you close on your home Nov.

Multiply the number of months by 30 days. What fees does a seller pay at closing in Florida. 1 and the seller has paid the taxes through Dec.

A number of different authorities including counties municipalities school. 097 of home value. Outside of Miami-Dade County Outside of Miami-Dade County the transfer tax rate is 70 cents per 100 of the deeds consideration.

Based on the price of the property Lender Charges Determined by your lender State and Local Taxes State Mandated Formula Inspections and Surveys 3rd Party Vendors Buyers and Sellers Charges In Florida similarly to other states closing costs are charges that applied to both parties in a real estate transaction the buyer AND the seller. Divide the total monthly amount due by 30. In Florida youll also have to post a fee for documentary stamps or doc stamps which is a percentage of the sales price.

Subtract from 30 the number. Florida Documentary Stamp Tax 7000. 4200 12 350 per month.

Wire transfer fees 50. How Are Real Estate Taxes Prorated At the Closing. Real property taxes are paid in arrears meaning at the end of the year in Florida and are not assessed until November of the year for which they are due.

Luckily the system counts the number of days from Jan 1 through Oct 28 301. Divide the total annual amount due by 12 months to get a monthly amount due. In other words you can calculate the transfer tax in the following way.

Property taxes in Florida are implemented in millage rates. How Much Are Property Taxes at Closing.

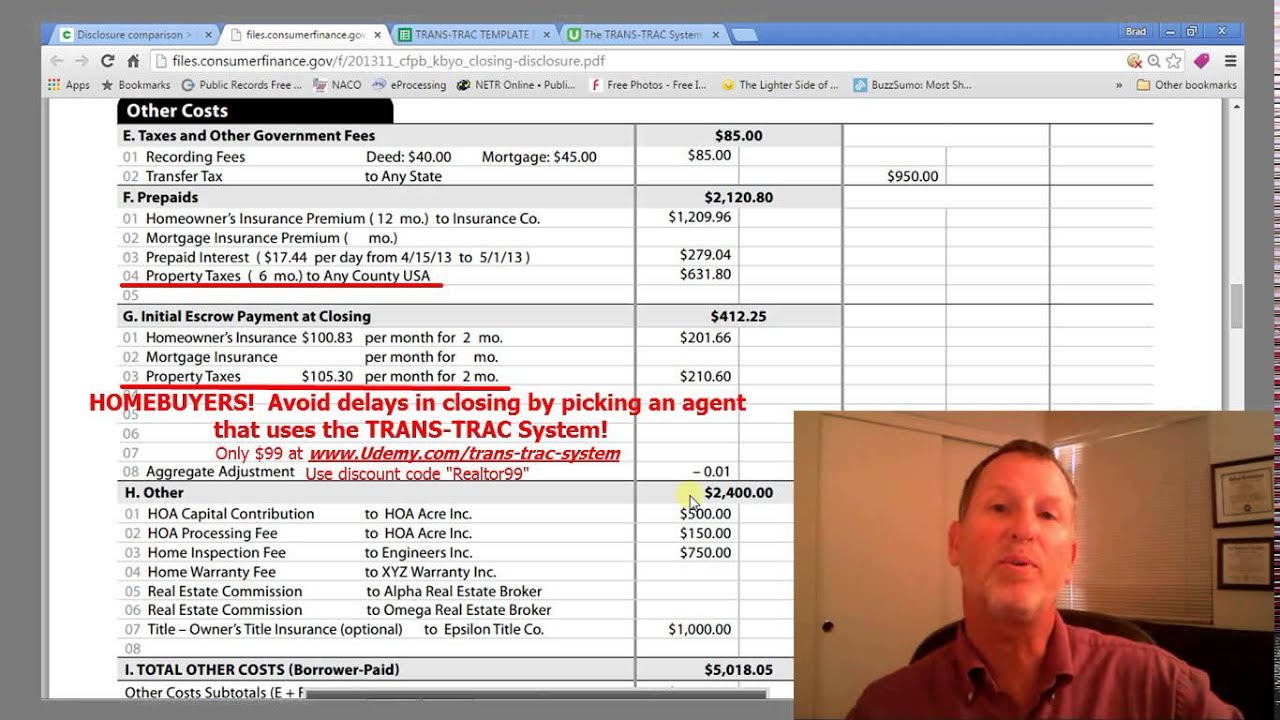

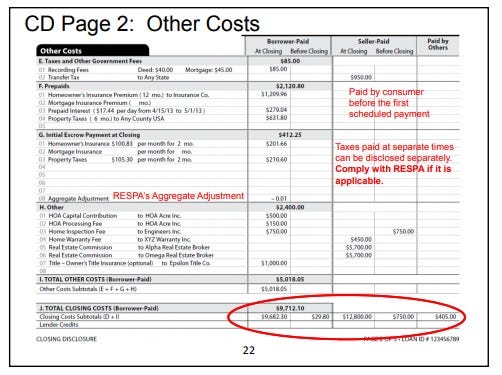

Property Taxes Explained On Closing Disclosure Youtube

This Is A Question That Remains Ever Popular Among Home Buyers Closing Costs Are The Fees Associate Real Estate Infographic Buying First Home Real Estate Tips

First Time Home Buyer Vocab Cheat Sheet Free Online Mortgage Calculator Tools Calculate Your Real Estate Infographic Selling Real Estate Buying First Home

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Property Tax How To Calculate Local Considerations

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Mortgage Interest Rates

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Cape Coral Florida Condos For Sale Cape Coral

Property Tax Prorations Case Escrow

First Time Home Buyer Vocabulary Cheat Sheet Buying First Home Home Buying First Time Home Buyers

1sttimehomebuyers Home Buying Credit Card Realistic

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

Hauskauf Zum Ersten Mal Von Einem Erstkaufer Privathauser A Einem First Time Home Buyers Real Estate Infographic First Home Buyer

Understanding Property Taxes At Closing American Family Insurance

Buying A Home Isn T Just A Possible 20 Down Payment And A Monthly Check For The Mortgage There A Buying Your First Home Home Buying Process Buying First Home

Deducting Property Taxes H R Block

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Homes For Sale Real Estate Listings In Usa Buying First Home Home Buying Real Estate